Budget 2024 predictions

With the new Labour government warning October’s budget will be ‘painful’ as it aims to plug a £22billion black hole in public finances and Prime Minister Keir Starmer saying those with the ‘broadest shoulders should bear the heavier burden’, we look at what’s expected in the budget and how it’s likely to affect homeowners….

Will inheritance tax increase?

There is strong speculation that there will be sweeping changes to inheritance tax in the forthcoming budget in an attempt to raise billions of pounds for the coffers. As it stands, you’ll pay inheritance tax at 40% on an estate on everything above the tax-free inheritance tax allowance of £325,000. However, only about 4% of estates need to pay inheritance tax, according to HMRC. This is because there is no inheritance tax payable when inheriting from a dead spouse or civil partner and you will also inherit your spouse’s unused nil-rate band. Plus, providing you leave your home to direct descendants there’s an additional property allowance of £175,000 each. This gives the maximum combined allowance of £1,000,000.

There’s speculation that the budget could include cutting tax-free allowances or gifting allowances: for example, the tax breaks relating to spouses and civil partners. Read more about inheritance tax in our guide 9 ways to avoid inheritance tax.

Capital Gains Tax changes

With Labour pledging not to increase Income Tax or National Insurance, speculation is rife that Capital Gains Tax (CGT) will be hiked in the 2024 Budget. Capital gains tax is charged on profits you make from selling an asset like a second property or shares. Read our guide on Capital gains tax on property when selling.

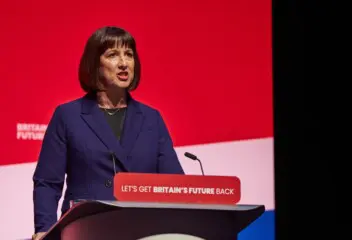

However, it has been reported in The Times that Rachel Reeves will use her budget to increase capital gains tax on the sale of shares and other assets but will not change the rate for selling a second property due to concerns people would defer selling to avoid being hit by higher rates.

In recent weeks, it had been speculated that CGT would increase in line with income tax, but that now looks unlikely. Keir Starmer has rejected reports it could rise to as much as 39%, saying suggestions of such a big rise were “wide of the mark”.

However, many landlords have already started selling Buy to Let properties as they anticipated they would be hit by higher CGT rates.

Stamp duty surcharge hike for foreign buyers

Labour is expected to fulfil a manifesto pledge to increase the stamp duty surcharge for foreign buyers. Currently, if you’re a non-UK resident, you’ll pay a 2% surcharge on top of normal stamp duty rates. It has been reported that the Chancellor is expected to increase this surcharge to 3% in an effort to prioritise British housebuyers – a move which we strongly support. Read our guide on Stamp Duty: Who pays it? When? And how much?

First time buyer stamp duty relief ‘to be cut’

The threshold for paying first-time buyer stamp duty was increased from £300,000 to £425,000 in September 2022. But this benefit for first time buyers was only announced as a temporary measure and is set to be reversed in April 2025. Ahead of winning the 2024 general election, Labour said that if they won, the first-time would revert to £300,000.

If they follow through with this, first time buyers currently in the process of buying will need to act fast to avoid paying more in stamp duty.

We’ll be very disappointed if first time buyer stamp duty relief is cut back to £300,000 as it will make it even harder for people to buy their first home.

In this Budget we’re calling on the government to scrap stamp duty altogether. Over the last decade of campaigning there have been as many tweaks to the stamp duty land tax as there have been new housing ministers. This fruitless fiddling has done little to address the fundamental problem that stamp duty is a tax on homeownership that’s a major obstacle to the housing market functioning properly. It puts off families from moving up the property ladder, fleeces homeowners needing to make a sideways move and makes it more expensive for older generations to downsize. Find out more in our Scrap stamp duty campaign.

Council tax reform

While the government have promised not to touch the the single person council tax discount, which reduces council tax by 25%, they haven’t rules out reforming the current council tax band system. There is some speculation reported in ThisIsMoney that they could replace it with a flat 0.5% tax based on the home’s value. If this happens, people living in areas with high property values will be hardest hit.

Some second home owners in England already face paying twice the amount of second home council tax from April 2025. While those owning empty properties also currently pay higher council tax bills too. In Scotland, local authorities can already charge up to double council tax rates on second homes while in Wales, local authorities can charge a council tax premium of up to 300% on second homes. Read more in our guide Second home council tax explained.

Right to Buy scheme reforms

There’s speculation the government may reform the Right to Buy scheme by slashing the discounts for council tenants who want to buy their home under the scheme. There’s also reports the rules may be tightened up to increase the length of time you need to have lived in the home for to qualify and for the scheme to be limited to newly build council homes only. The government’s argument for reform is to retain much needed social housing stock.

Freedom to Buy

Ahead of the general election, Labour pledged to launch the Freedom to Buy scheme which would offer a permanent mortgage guarantee scheme. But few details have been released on how it will work. We hope the Budget will flesh this out and provide more information on how the Freedom to Buy scheme will work.

Lifetime ISA reform

If the government really wants to help first time buyers, then updating the Lifetime ISA scheme is a no-brainer. By removing the outdated 6.25% LISA withdrawal fine for people buying a home above the current £450,000 price limit – a threshold that hasn’t changed since 2017 – more people would have confidence to save into the scheme. The government needs to find a way to make sure these schemes keep up with house price reality and people wanting to use their savings to buy a home aren’t penalised.

Rent a Room scheme reform

Another scheme that has been ignored for too long is the Rent a Room scheme. Under the current scheme homeowners can rent out a room in their home, helping them afford soaring mortgage payments. We successfully campaigned in 2015 to get the Rent a Room Relief increased so that £7,500 of any income is tax-free. But this figure hasn’t been revised since then.

We think there is no better time – when the UK is buckling under a cost of living and housing crisis – to extend the tax free earnings. The average cost to rent a room in the UK stands at £739/month (£8,868/year) or £1,014 in London (£12,168/year). To encourage further take up, help boost household incomes and give more people a roof over their heads, we think the model should be tax free up to £10,000.

Better energy efficiency grants

Our research shows more than one third of homeowners (36%) have been held back from making energy efficiency improvements to their homes due to cost and 18% said the savings may not justify the up-front cost. Lack of incentives and grants is a barrier for 1 in 5 homeowners (19%).

Clearly, more support is needed to help people keep their homes warm. And it couldn’t be more timely given that millions of pensioners will lose the winter fuel allowance.

Let us know what you want to see in the forthcoming Budget in the comments below

February 3, 2026

February 3, 2026