- Housing crisis deepens as concern rises over prices and availability

- 83% of adults now consider house prices serious problem

- Three quarters (77%) say availability is a serious issue

- Crisis worse in London where leasehold problems and house prices hit hard

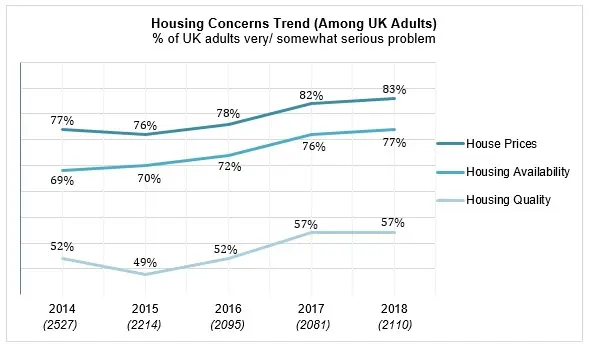

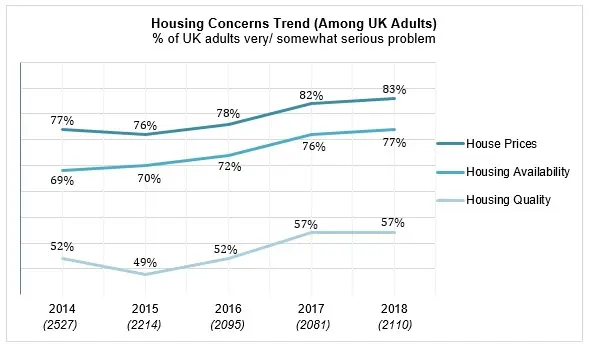

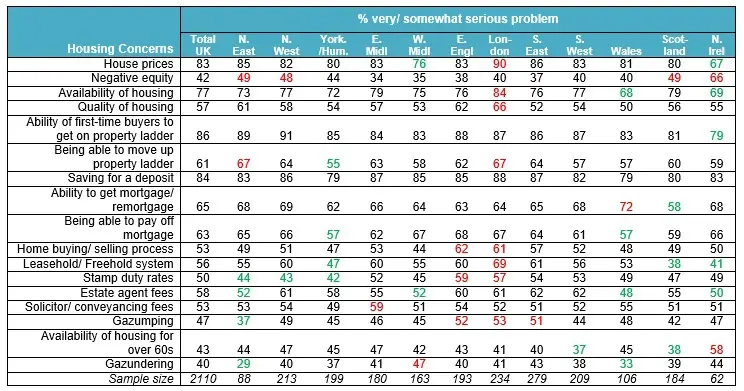

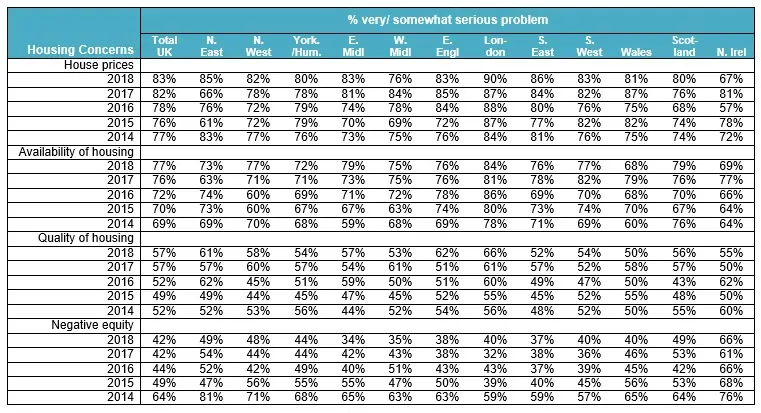

A massive 83% of people believe house prices are a ‘serious’ problem, up from 77% five years ago, according to the Homeowners Survey 2018. Meanwhile 77% of respondents say availability of housing is now a major concern, up from 69% in 2014.

The YouGov survey, polling over 2000 UK adults, is conducted on behalf of HomeOwners Alliance and BLP Insurance and has been trending housing concerns for five years.

In further evidence of the worsening crisis, the survey found the quality of homes is a growing issue with 57% of adults saying it is a serious problem up from 52% in 2014.

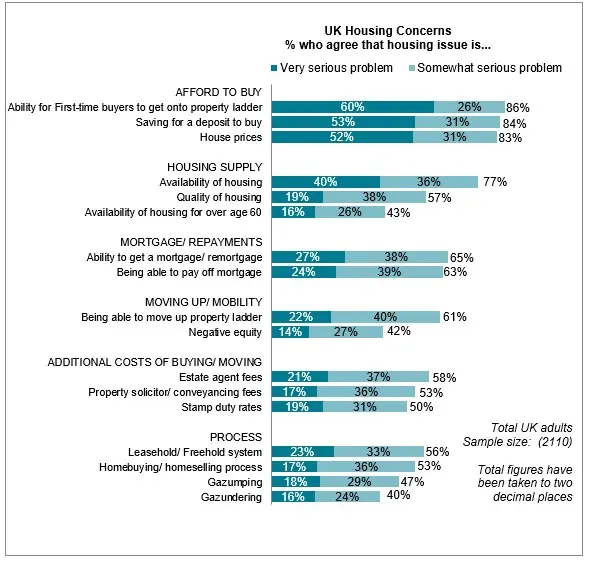

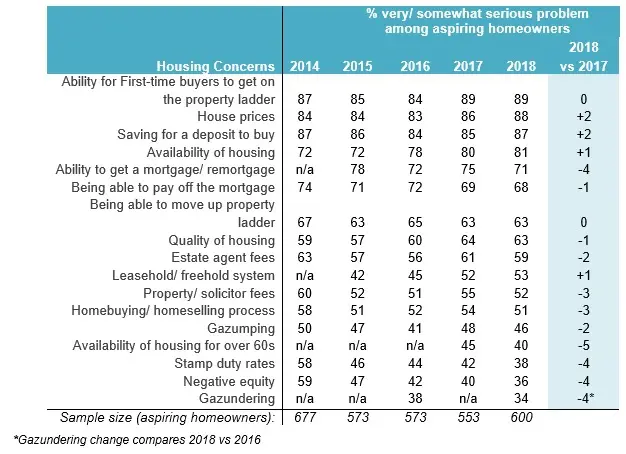

The results reveal a worsening picture for those wanting to get a foot on the property ladder. Among aspiring first time buyers, the proportion saying house prices (86%) and saving for a deposit (87%) is a serious problem is up over the past year.

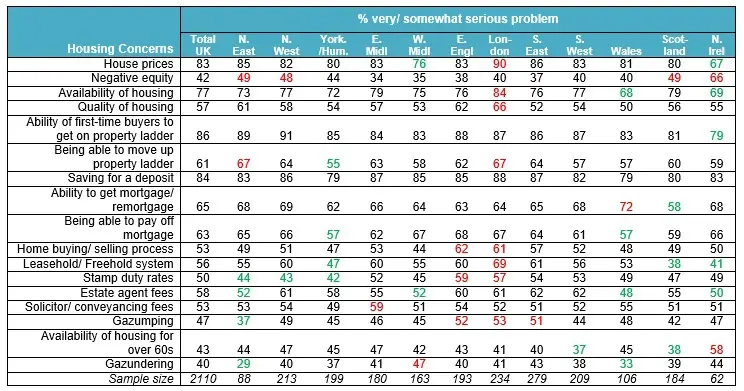

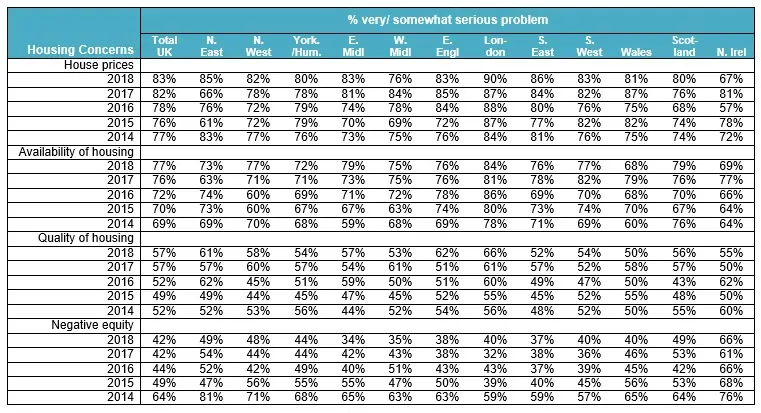

Meanwhile those in London are feeling the impact of the crisis harder than most. Today the vast majority of Londoners (90%) say house prices are a serious problem (up from 84% in 2014) and 84% say availability of housing is a serious problem (up from 78% in 2014) and 66% say quality of housing is a serious problem (up from 56% in 2014).

London continues to be a ‘hotbed’ for housing concerns. House prices, availability of housing, quality of housing, being able to move up the ladder, stamp duty rates, the leasehold/ freehold system, the home buying and selling process and gazumping all register higher levels of concern among Londoners.

Paula Higgins, Chief Executive, HomeOwners Alliance, says:

“The housing sector in the UK is on its knees. There’s a shortage of building, a constant stream of stories surrounding poor quality and unfair deals for homeowners, a lack of social housing, rising homelessness and a leasehold system that is dangerously broken. As our survey shows, these problems have escalated over the last five years and the crisis is deepening. We’ve become desensitised to the headlines.

“People are just as keen as in previous years to own a home but the system is failing them, despite the introduction of flagship schemes like Help to Buy. Although Brits have reacted positively to government’s changes to stamp duty house prices and availability continue to be major concerns year on year. It’s telling that leasehold issues have been by far the fastest growing concern for the last 2 years – the government needs to hurry up with their plans for leasehold reform and be more ambitious.”

Kim Vernau, Chief Executive, BLP Insurance, says:

“The results of this survey paint a bleak picture for both the UK housing industry and potential homeowners. Concerns around quality of build reflect the serious deficiencies in quality within design and build procurement which are severely impacting confidence in the housing sector. To meet this challenge design codes and reviews should be implemented industry-wide.

“No single initiative will solve the current housing crisis. Steps need to be taken to stimulate SME housebuilders, embrace technologically innovative build methods and encourage new entrants into an industry suffering from a shortage of skilled workers. It is the responsibility of all stakeholders involved, from government to large developers to SME builders, to commit to meaningful change and push the industry forwards in delivering more, better quality and affordable housing options for those wanting to get on the housing ladder.”

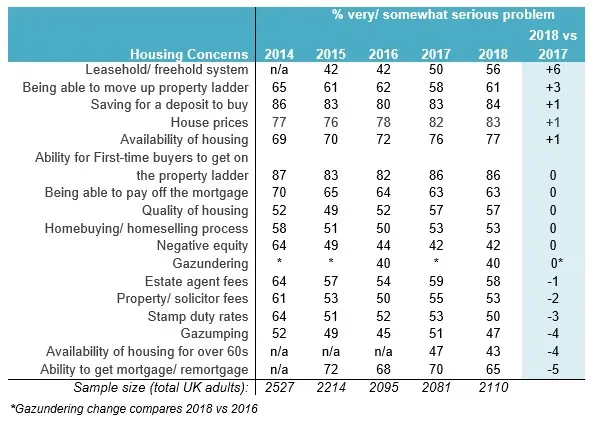

The research also found the much-criticised leasehold system is the fastest growing housing issue for the second year running with 56% of UK adults now citing it as a serious concern, up from 50% in 2017. These figures are even higher in London at 69%, up from 53% in 2017.

With additional stamp duty reforms introduced this year to assist first-time buyers, concern with stamp duty has subsided further over the past year (now 38% of UK adults say stamp duty is a serious problem down from 58% in 2014). Regionally, concern about stamp duty rates is higher in East of England (59%) and London (57%) and lower in the North.

Key Findings from the 2018 Annual Homeowner Survey:

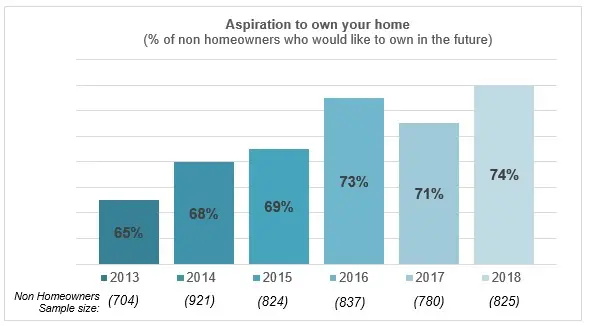

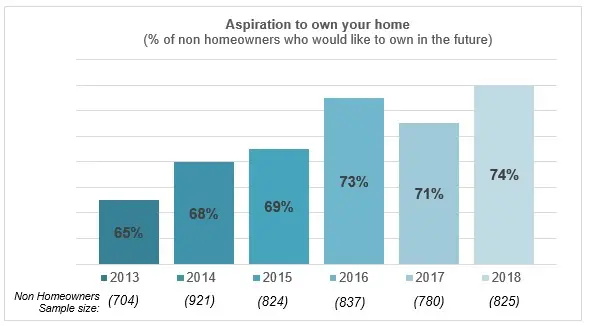

- Aspiration to own has resumed its upward climb. Nearly three in four non homeowners (74%) would like to own their home one day. See Figure 1 Trend Aspiration to Own

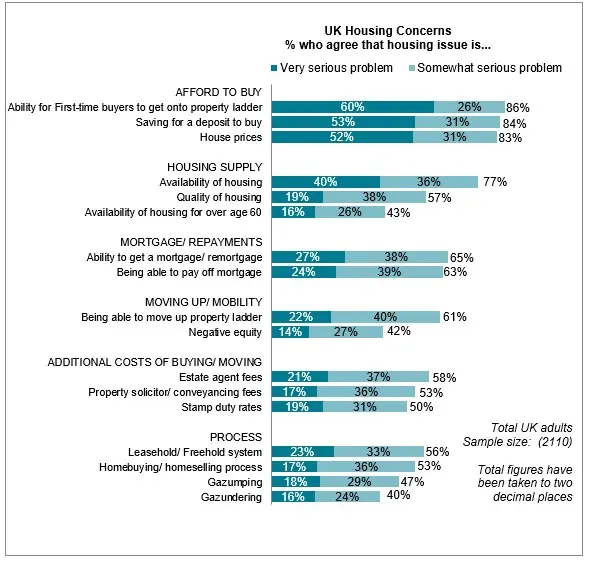

- Difficulties related to buying your first home top the list of housing problems. 86% of UK adults say the ability to get on the property ladder is a serious problem; 84% say saving for a deposit is a serious problem. See Figure 2 Top Housing Concerns

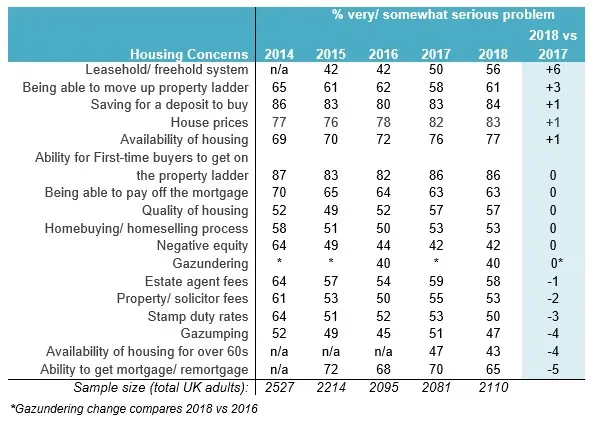

- Housing crisis deepens as house prices, availability and quality of homes seen to be growing problems. 83% of UK adults say house prices are a problem up from 77% in 2014. More than three-quarters (77%) of UK adults say availability of housing is a serious problem, up from 69% in 2014. Similarly, quality of homes is a growing issue with 57% saying it is a problem up from 52% in 2014. See Figure 3 Housing Concerns Trend

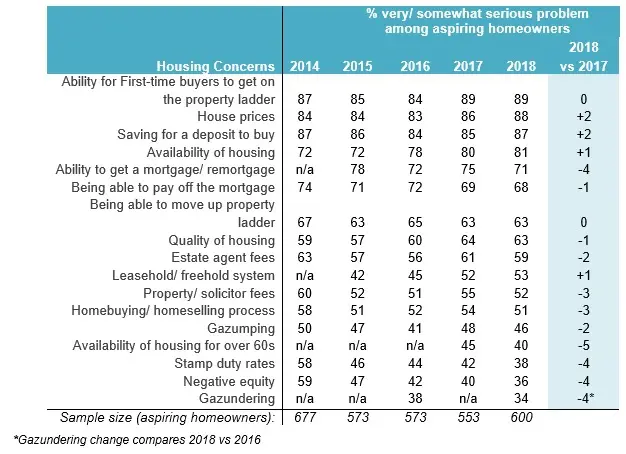

- For aspiring homeowners, the ability to get on the ladder, house prices, saving for a deposit and availability of homes are biggest issues and worsening with time. Among aspiring first-time buyers, 89% say the ability of first time buyers to get on the property ladder is a serious problem, 88% say house prices are a serious problem (up 2% in past year), 87% say saving for a deposit is a serious problem (up 2% in past year) and 81% say the availability of homes is a serious problem (up 1% in past year). See Figure 4 Housing Concerns Trend among Aspiring First-Time Buyers

- The fastest rising housing issue over the past year is the leasehold/ freehold system. Up 6% in 2017 and up 8% in 2017, 56% say the leasehold/ freehold system including service charges, ground rent and other fees is a serious problem. Even higher levels of concern are registered in London – 69% (up from 53% in 2017).

- The proportion who say getting a mortgage or remortgaging is a problem is down. Down 5% over the past year, 65% of UK adults say the ability to get a mortgage/ remortgage is a problem (and down from 72% in 2015). A similar drop is evidenced among aspiring first-time buyers, down 4% in the past year, 71% of aspiring homeowners say getting a mortgage is a problem (down from 78% in 2015).

Stamp duty has further receded as an issue. Likely as a result of first-time buyer relief, the proportion registering this as a problem has reduced 3% over the past year to 50% (and down from 64% in 2014).

- Negative equity remains a more significant issue in certain parts of the country. 42% of UK adults overall say negative equity is a serious problem, while the level is higher in Northern Ireland (66%), Scotland (49%), the North East (49%) and North West (48%).

Regional Findings from the 2018 Annual Homeowner Survey:

See Figure 5 & 6 2018 Regional Housing Concerns & Regional Housing Concerns Trend

- London remains a hotspot for housing issues

- House prices, the availability and quality of homes, the leasehold/ freehold system, being able to move up the ladder, stamp duty, the home buying/ selling process and gazumping all register higher levels of concern in London than they do nationally.

- 90% of Londoners up from 84% in 2014 say house prices are a serious problem.

- 84% in London up from 78% in 2014 say housing availability is a serious problem.

- 66% of Londoners up from 56% in 2014 say quality of housing is a serious problem.

- Negative equity concern higher in Northern Ireland (66%), North East (49%), North West (48%) and Scotland (48%) than UK level overall.

- Availability of housing for those over age 60 is a bigger issue in Northern Ireland (58%)

- than UK overall (43%) and less so in South West (37%) and Scotland (38%).

- Leasehold/ freehold system is less likely to be seen as a serious issue in Scotland (38%) and Northern Ireland (41%).

Figure 1: Trend Aspiration to Own (Among Non-Homeowners): 2013-2018 Homeowner Survey

Figure 2: Top Housing Concerns (Among UK Adults): 2018 Homeowner Survey

Figure 3: Housing Concerns Trend among Total UK Adults (2014-2017 Homeowner Survey)

Figure 4: Housing Concerns among Aspiring Homeowners (2014-2018 Homeowner Survey)

Figure 5: Regional Look at Housing Concerns: 2018 Homeowner Survey

Figure 6: Regional Housing Concerns Trend: (2014-2018 Homeowner Survey)

June 26, 2025

June 26, 2025