- Moving Costs

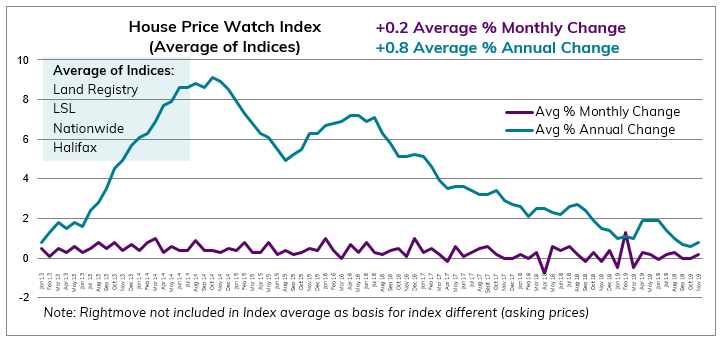

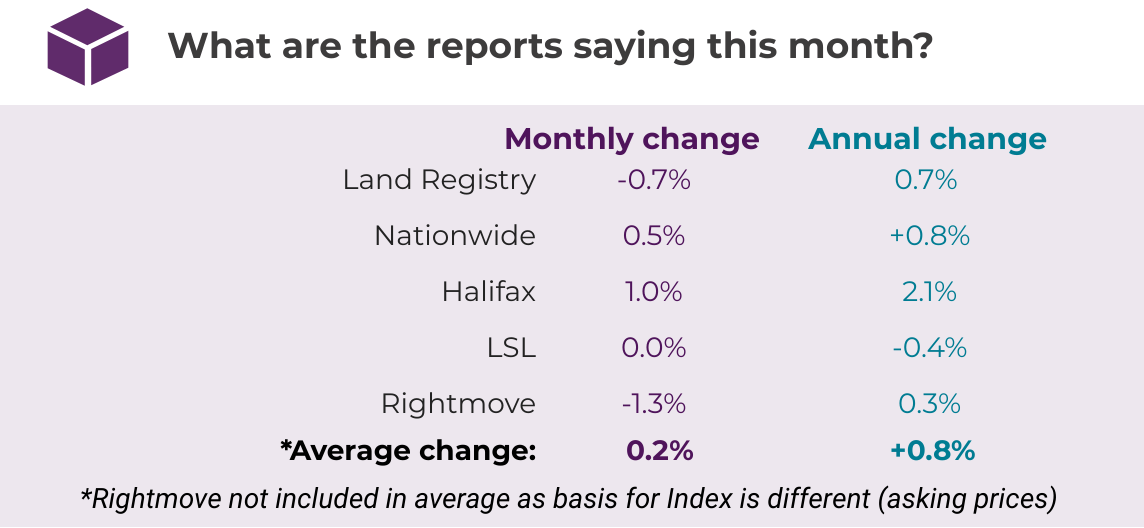

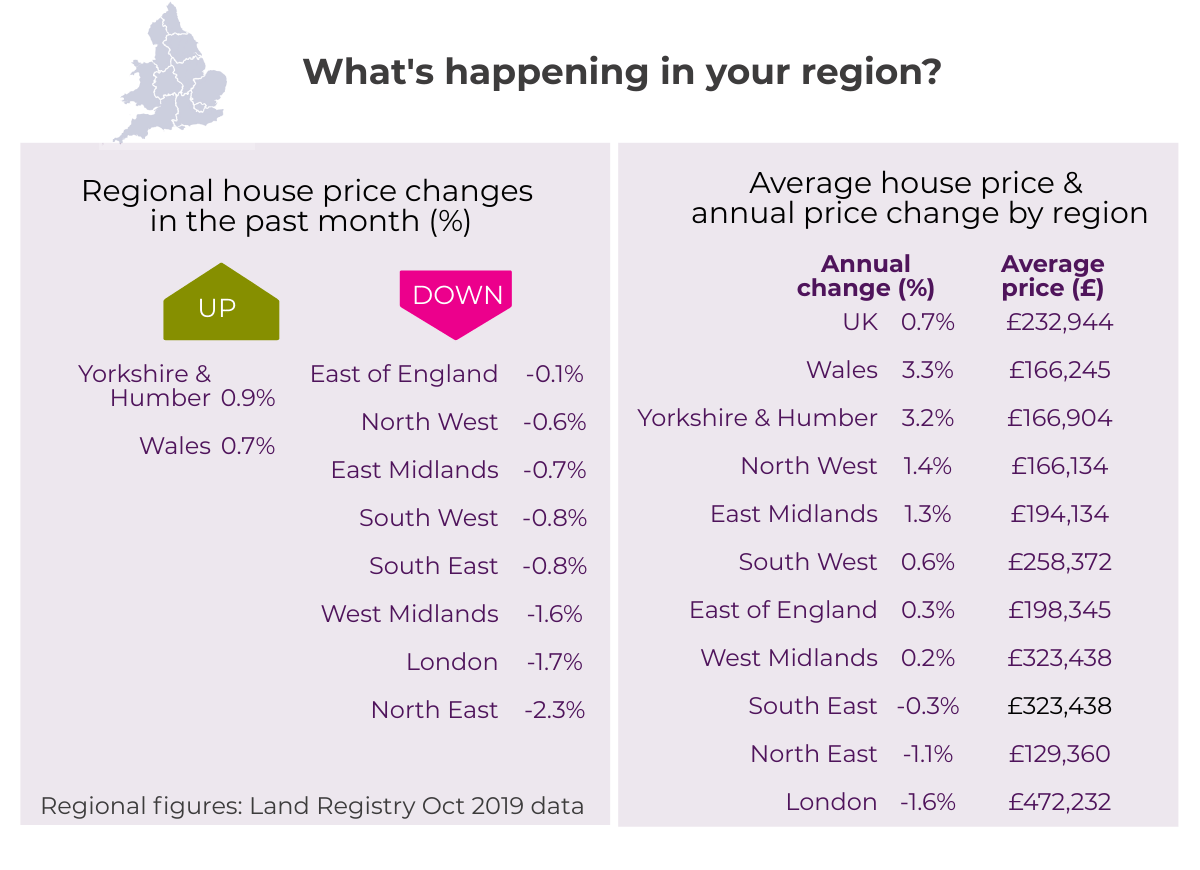

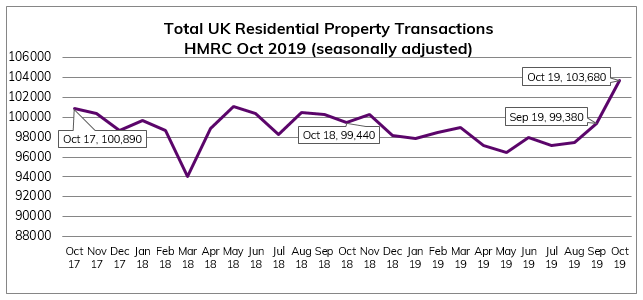

- House Price Index

- Cost of moving calculator

- Costs of buying a house

- Costs of selling a house

- Conveyancing fees

- House survey costs

- Removals costs

- Estate agent fees

- EPC cost

- Estate agent fees calculator

- Bridging loan calculator

- Stamp duty calculator

- How much can I borrow calculator

- Mortgage cost calculator

- Loan to value calculator

- Mortgage equity calculator

- Buy to let mortgage calculator

- Quote Finder

- Conveyancing quotes

- House survey quotes

- Homebuyers insurance

- Best local estate agents

- Instant house valuation

- Rent calculator

- EPC quotes

- Removals quotes

- Remortgage finder

- Find an IFA

- Find a leasehold expert

- Find an architect

- Compare home insurance

- Life insurance quotes

- Compare energy deals

- Looking for something else?

- For Buyers

- Step by step guide to buying

- How to buy your first home

- First time buyer schemes

- Buying a new build home

- Buying a leasehold property

- Shared ownership: pros & cons

- Buying a second home

- Viewing a property checklist

- Making an offer & negotiating

- Questions to ask when buying

- House survey types & costs

- Conveyancing for buyers

- Completion: what to expect

- Moving house checklist

- All buying guides

- For Owners

- Managing Money

- Should I remortgage now?

- Should I pay off my mortgage?

- How do I value my property?

- Capital gains tax on property

- Second home council tax explained

- Mansion tax valuation

- Do I need an IFA?

- Avoid selling house to pay for care

- Inheriting a property

- Divorce: what happens to the home?

- What's happening with energy prices?

- How should I insure my home?

- How does life insurance work?

- Critical illness cover explained

- Income protection insurance

- Improving

- Home extension: where do I start?

- Loft conversion: where do I start?

- Garage conversion: where do I start?

- Do I need planning permission?

- Cost of planning permission

- Find a builder

- Architect fees

- Do I need a structural engineer?

- Structural engineer cost

- Do I need a party wall agreement?

- Party wall surveyor cost

- Interior design service

- Leasehold

- New Build

- Managing Money

- For Sellers

- Step by step guide to selling

- Selling & buying a house process

- What price should I sell for?

- Make your home more valuable

- Do I need an EPC?

- Documents to sell your house

- How to find the best estate agent

- Compare online estate agents

- Accepting an offer - what to consider

- Porting your mortgage

- Selling with a Help to Buy loan

- Selling a leasehold property

- How to sell your home at auction

- Conveyancing for sellers

- Solicitor fees for selling a house

- TA6 form explained

- All selling guides

- Mortgages

- Compare Mortgage Rates

- Best mortgage rates

- Best mortgage lenders

- Mortgage rate forecast

- Remortgage Service

- How to remortgage

- First time buyer mortgages

- First time buyer mortgage rates

- How much can I borrow?

- How to get a mortgage

- Gifted deposits explained

- Mortgages for over 50s

- Buy to Let mortgages

- Buy to Let Mortgage Rates

- Bridging loans explained

- Deposit unlock

- Own new rate reducer scheme

- Life insurance with a mortgage

- News

Find the best estate agent near you Start here