Aug 2020 House Price Watch

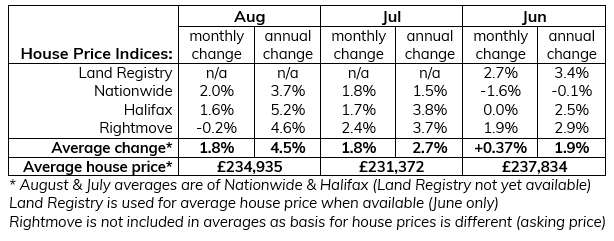

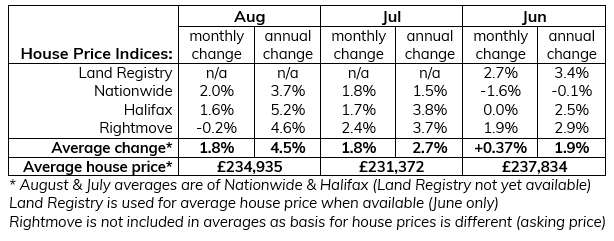

Summer surge in activity and house prices – house prices up 1.8% on average in past month, and up 4.5% on average in past year

Completed transactions are up 14.5% in July and agreed sales in August are reported to have continued apace. House prices are growing at their fastest rate in recent memory. Pent up demand, a renewed interest in moving as a result of life in lockdown, and the stamp duty holiday are all seen to be fuelling activity. This trend is expected to continue in the short term. However, most economic forecasters are predicting a sharp rise in unemployment and, if this comes to pass, we expect a dampening of activity and house prices in the medium term.

House price growth accelerates in August

The rate of annual house price growth is up from 2.7% in July to 4.5% in August.

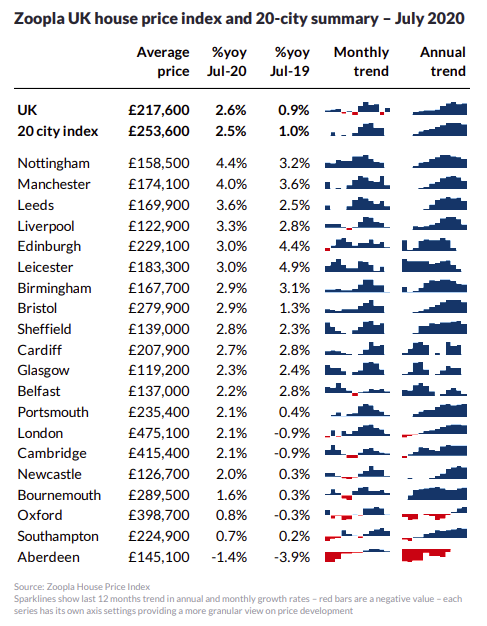

House prices rise in most UK cities

Latest regional house price data (July 2020 Hometrack City Index) shows house prices are up in most areas. Northern cities are experiencing the biggest year on year price increases.

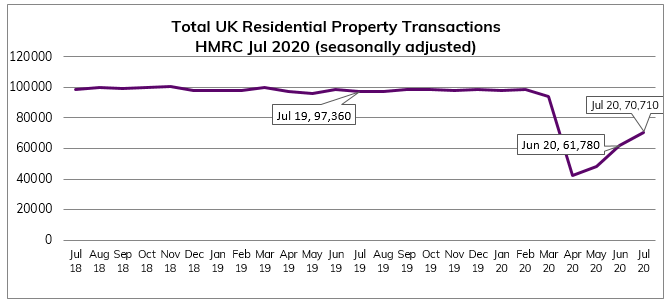

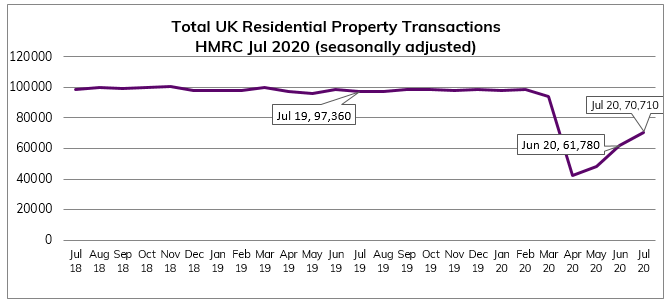

Transaction levels rise sharply over the past month but remain below 2019 levels

Home sales are up 14.5% in July but transactions are still below pre-lockdown levels and are 27% below July 2019.

RICS residential market survey indicates buyer enquiries, agreed sales and new instructions all continued to rise firmly in August. Expectations for the next 3 months signal continued growth in sales. Further out, concerns over the broader economic climate continue to drive a subdued view for sales market activity at the twelve-month horizon.

What the indices say?

HomeOwners Alliance: “We have seen a summer surge in activity with a record rise in house prices this month by recent standards. The boom is a result of pent up demand from the lockdown period coming through, more people considering moving as a result of life in lockdown, and the stamp duty holiday providing further incentive to move now. Renewed activity looks set to continue in the near term but with economic forecasters expecting rising unemployment, we are likely to see a dampening effect on activity and house prices in the medium term.

Nationwide: “House prices have reversed the losses recorded in May and June and are at a new all-time high. The bounce back reflects the unexpectedly rapid recovery in housing market activity since the easing of lockdown restrictions. Pent up demand is coming through, where decisions taken to move before lockdown are progressing. Behavioural shifts may also be boosting activity, as people reassess their housing needs and preferences as a result of life in lockdown. These trends look set to continue in the near term. However, most forecasters expect labour market conditions to weaken as a result of the aftereffects of the pandemic and as government support schemes wind down. If this comes to pass, it would likely dampen housing activity once again in the quarters ahead.”

Halifax: “House prices continued to beat expectations in August, with prices again rising sharply. Annual growth is at its strongest level since late 2016. A surge in market activity has driven up house prices through the post-lockdown summer period, fuelled by the release of pent-up demand, a strong desire amongst some buyers to move to bigger properties, and of course the temporary cut to stamp duty. Notwithstanding the various positive factors supporting the market in the short-term, it remains highly unlikely that this level of price inflation will be sustained. With most economic commentators believing that unemployment will continue to rise, we do expect greater downward pressure on house prices in the medium-term.”

Rightmove: “There have been many changes as a result of the unprecedented pandemic, and these include a rewriting of the previously predictable seasonal rulebook for housing market activity and prices. Home movers are both marketing and buying more property than we have recorded in any previous month for over ten years, helping push prices to their highest ever level in seven regions. Rather than just a release of existing pent-up demand due to the suspension of the housing market during lockdown, there’s an added layer of additional demand due to people’s changed housing priorities after the experience of lockdown. This is also keeping up the momentum of the unexpected mini-boom.”

RICS: “The August 2020 RICS UK Residential Survey results continue to portray strong momentum behind the sales market at present, even if the longer term view remains more cautious. Meanwhile, the pandemic is expected to cause a lasting shift in the desirability of certain property characteristics, as 83% of respondents anticipate demand increasing for homes with gardens over the next two years.”

To see previous House Price reports click here

How this site works

HomeOwners Alliance Ltd is registered in England, company number 07861605. Information provided on HomeOwners

Alliance is not intended as a recommendation or financial advice.

Mortgage service provided by London & Country Mortgages (L&C), Unit 26 (2.06), Newark Works, 2 Foundry Lane, Bath

BA2 3GZ, authorised and regulated by the Financial Conduct Authority (FRN: 143002). The FCA does not regulate

most Buy to Let mortgages. Your home or property may be repossessed if you do not keep up repayments on your

mortgage.

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of LifeSearch Limited, an Appointed

Representative of LifeSearch Partners Ltd, authorised and regulated by the Financial Conduct Authority. (FRN:

656479).

Independent Financial Adviser service is provided by Unbiased, who match you to a fully regulated, independent

financial adviser, with no charge to you for the referral.

Bridging Loan and specialist lending service provided by Chartwell Funding Limited, registered office 5 Badminton Court, Station Road, Yate, Bristol, BS37 5HZ, authorised and regulated by the Financial Conduct Authority (FRN: 458223). Your property may be repossessed if you do not keep up repayments on a mortgage or any debt secured on it.