New build warranties aren’t all they seem

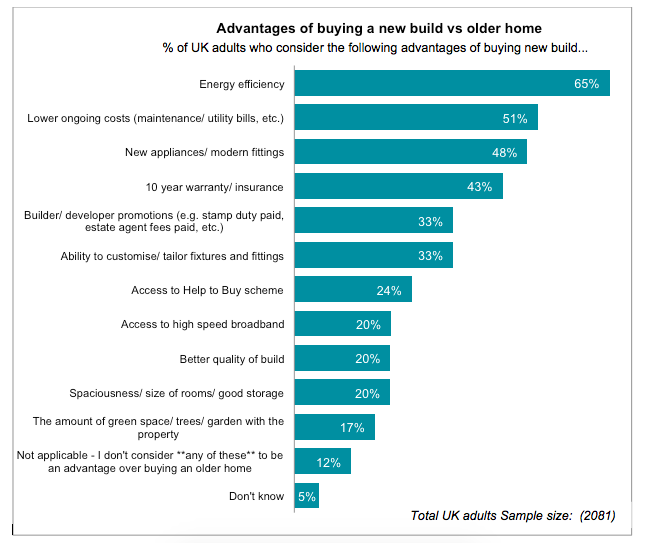

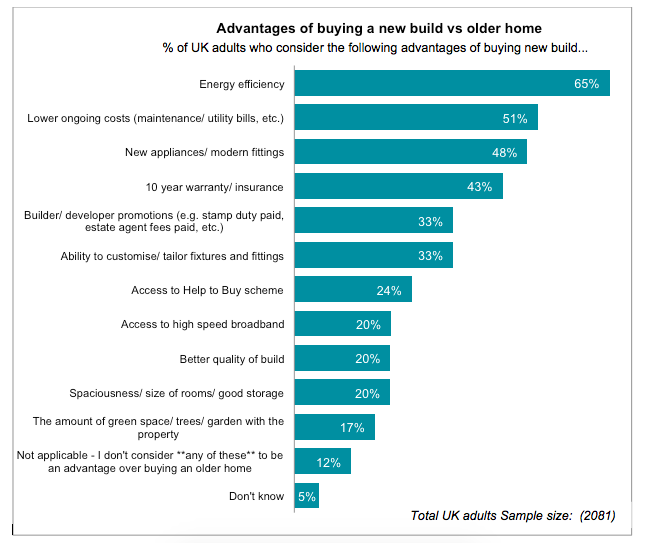

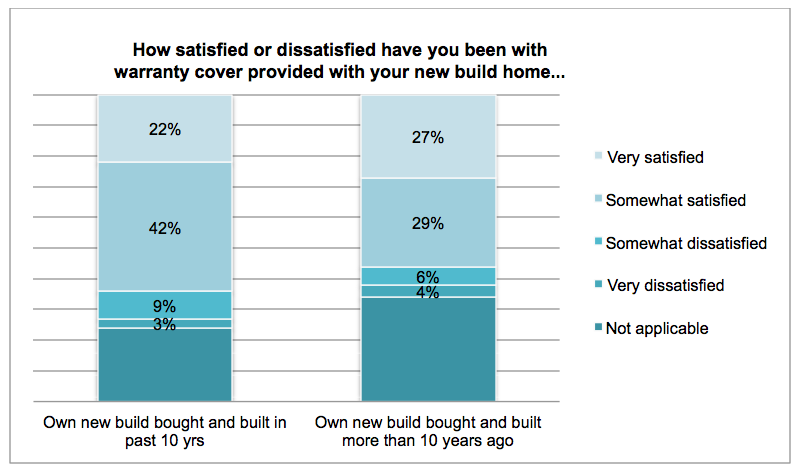

New homes are often marketed by developers with the promise of lengthy warranties offering peace of mind. Indeed, 58% of people who have bought these types of home in the last 10 years think that the warranty was an advantage over an older property. But home buyers opting for new build properties are being left exposed by warranties that fall short of their needs and expectations.

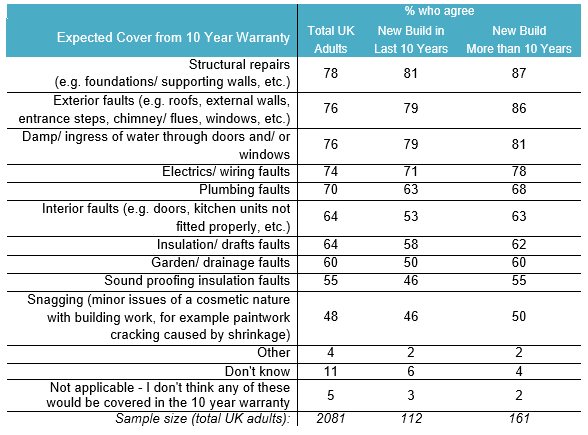

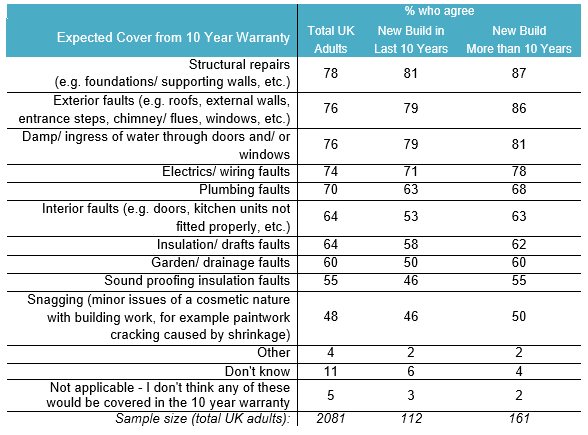

The 2017 Homeowner Survey conducted by YouGov for HomeOwners Alliance and BLP Insurance demonstrates that there is a clear mismatch between consumer expectation and reality. Nearly half of new build property buyers in the last 10 years (46%) expect the full 10-year warranty to cover minor snagging issues on their new build home when, in actual fact, standard warranties cover issues that relate to or affect the structure of the home.

The survey findings further reinforce conclusions from the All Party Parliamentary Group (APPG) report ‘More homes, fewer complaints’, which stated that consumers think a warranty is a hallmark of absolute quality. Often warranties cover far less than consumers assume, in responding to the 2017 Homeowner Survey, comments such as “Covered so little it was virtually worthless” and “The cover was minimal and far below expectations” were typical responses to the survey. Amongst consumers who have bought new build properties in the past ten years, the most common misperceptions around the types of faults which aren’t covered by the full 10 year warranty are electrical and wiring faults (71%), plumbing faults (63%), insulation and draft faults (58%).

Nor do many consumers appreciate that for the first two years after completion, it is down to the builder to sort out defects and after that the warranties cover matters that affect the structure of the home. Again, comments such as, “NHBC said everything I asked about wasn’t their problem” and “Builder very reluctant to snag and nothing seemed to be covered by NHBC warranty” were typical. Consumers also complain that where a problem was covered by the warranty, the provider was reticent to step in and help resolve disputes with the builder.

Commenting on the findings, Paula Higgins, Chief Executive of the HomeOwners Alliance said: “The house building industry needs to do a better job at helping buyers to understand the warranty system for new build homes, how it works and how warranties are structured. Where things do go wrong in the initial two-year period, they should be resolved swiftly. If problems aren’t fixed, the warranty provider needs to have the clout to compel developers to act. Consumers expect and deserve a warranty system that provides no fuss cover when problems arise as well as speedy payments for more complex issues.”

The main providers of new build warranties include NHBC, LABC and PremierGuarantee. The NHBC, which provides warranties for approximately 80% of new homes in the UK, has asked the Competition & Markets Authority (CMA) to reconsider some of the rules that bind it (imposed in 1995) now that there is more competition from other providers and more choice for house builders. In addition, the housebuilding industry has come under mounting pressure to raise quality standards from the aforementioned APPG report into the quality and workmanship of new housing in England.

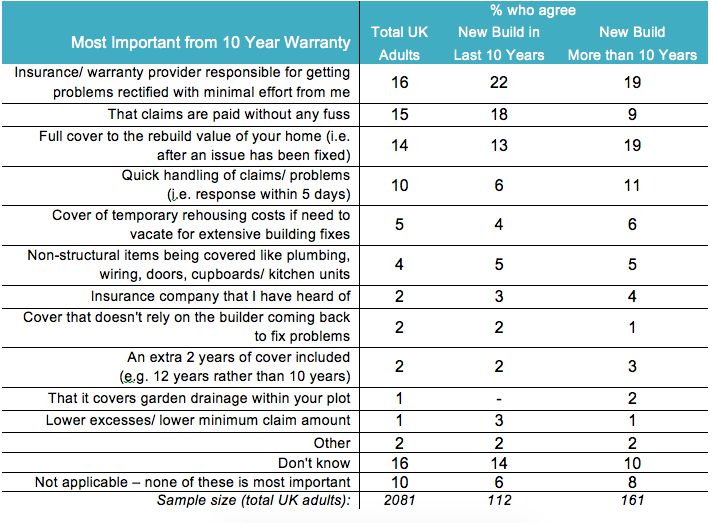

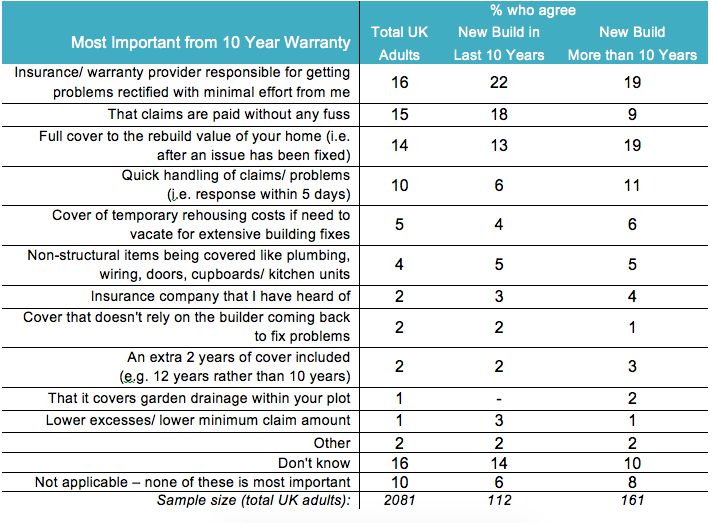

Consumers who have bought new build properties in the past ten years have three clear areas of importance. They want the warranty provider to take the lead on:

- resolving issues (22%)

- claims to be paid without fuss (18%)

- full cover to the rebuild value of their home (13%)

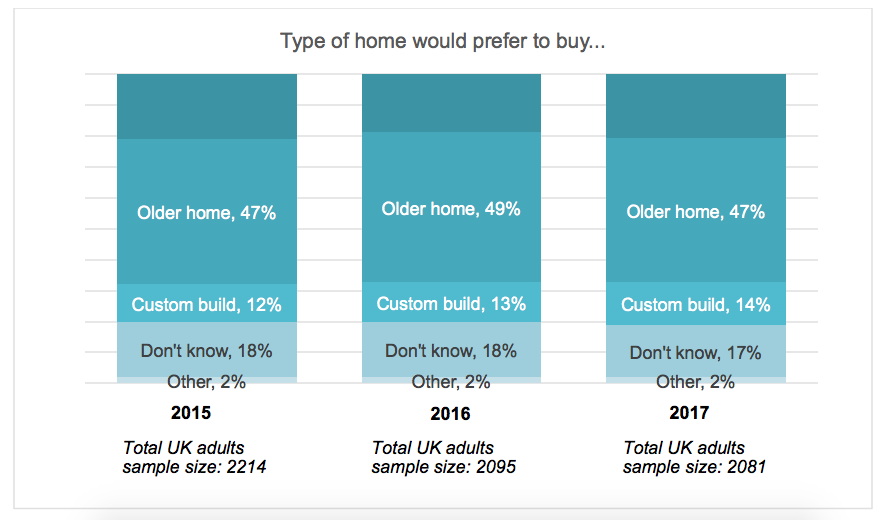

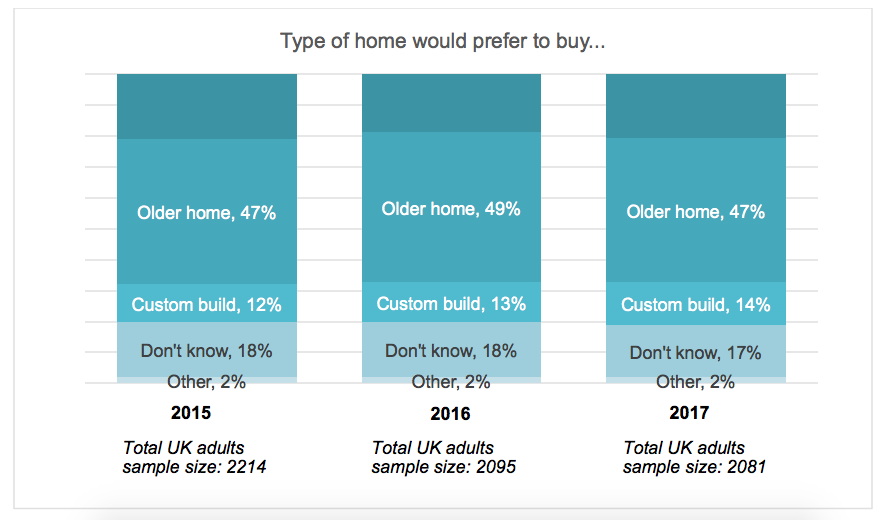

The problems caused by high expectations around warranties are unlikely to help new build homes become more popular. This is a real issue, with twice as many UK consumers (47%) saying that they would prefer an older home that’s more than 10 years old, to a new build home (21%).

Figure 1: Interest in Buying New Build

Figure 2: Advantages of Buying New Build Home

Figure 3: Faults New Build Homeowners Expect To Be Covered By Their Warranty Insurance

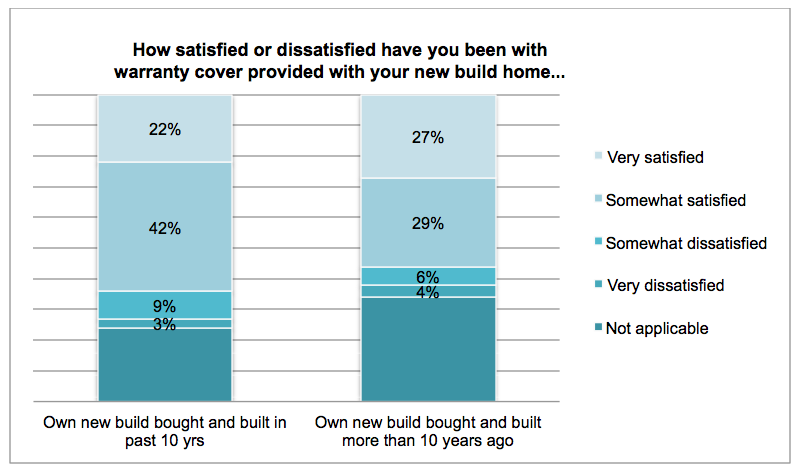

Figure 4 – Satisfaction with Warranty Cover Among New Build Homeowners

Figure 5 – Issues with Warranty Cover (Verbatim Comments)

Faults expected to be covered / not covered by warranty / not clear what faults covered

- “Covered so little it was virtually worthless / Seemingly nothing is actually covered / Doesn’t cover enough”

- “The cover was minimal and below expectations”

- “It seemed as if not much was covered with term cosmetic used when I raised a problem and rather off-putting response to the request for rectification work which seemed to suggest the warranty wasn’t worth paper it was written on!”

- “NHBC said everything I asked about wasn’t their problem”

- “Builder very reluctant to snag and nothing seemed to be covered by NHBC warranty”

- “Warranty not explained adequately so I could not see how good/bad it was./ As the specifics of what is covered is not provided and incorrect assumptions can be made.”

- “Its cover wasn’t very clear. Most faults I had were sorted by the builder coming back anyway.”

- “Details of insurance for escape of water and the damage caused were not explained clearly in the policy, and were not well understood by the loss adjusters.”

- “Our rendering badly stained because of building materials used and we weren’t covered”

- “Did not cover roofing problems”

- “There were a lot of cracks that appeared. And they would not cover this as it was seen as the house moving & stabilising”

- “Gaps developed in panels of the front door, letting in wind and rain, after 5 or 6 years, I was told within normal tolerances”

- “Windows failed and were not covered”

- “When the roof coping tiles disintegrated they did not want to know”

- “Windows were all scratched. The NHBC was a waste of time told him to leave my house. Eventually after a lot of stress they agreed to replace”

Lengthy or difficult claims process / Unwilling to pay out

- “Hard to claim for anything, too many get out clauses. Clever lawyers versus dumb customer as usual!”

- “Building warranty is a waste of time. Nobody would come and look at problems of less value than £10000!”

- “Never want to pay out”

- “Too many terms and conditions”

- “Took a long time to claim. Fobbed off all the time. Project was faulty, damp etc”

- “Claim took long time to finalise/ The amount of time it took to resolve my issue/ Not quick to react”

- “It was difficult getting problems sorted / Struggle to get resolution of problem / It is very difficult to deal with them”

- “Made small claim in the end gave up just took too long and they were not interested. Wanted my money not my claim”

- “Tedious chasing up people to fix things”

- “Paper guarantees don’t always manifest into practical action taken”

Difficulty getting problems put right by builder

- “Plethora of faults to be corrected, slow response from builder”

- “The builder retired and the insurance was useless”

- “The builders went bankrupt”

- “It was so difficult to get the builder back to rectify the problems”

- “Lots of issues were a real hassle to get fixed needing lots of chasing and we have potholes in the drive that they refused to fix then offered a bodge job. Would pay a snagging company to handle it next time”

- “We wrote to the builder asking for rectification of problems. We never received a reply”

Warranty provider no help in sorting problems with builder

- “The build quality of my house was such that the builder was found, in court, to be in breach of contract. The warranty provider (NHBC) was completely useless in the process of obtaining rectification. I had to do all the ground work necessary to force the builder to be contractually compliant and to pursue a successful legal action against the builder. In only one aspect (foul drains) was the NHBC of any use at all and that was four years after we moved in.”

- “NHBC policy didn’t cover an external wall despite a clear fault. The builder and the NHBC inspector seemed too familiar”

- “We had to have whole house redecorated as the finish had been rushed in order to complete on time. The builders failed to complete works they should have, regularly didn’t turn up when promised and the complaints process was terrible”

- “Builders will always do their utmost to get out of making things good. When my en suite shower cubicle leaked right from day one of completion, it was put to me that I should have had carpet laid as then I might never have noticed the water on the floor. Seriously not impressed!”

- “Asked me if any problems, I presented them with 4 sheets of items that needed attention, they said they would raise the bathtub to reach the (inadequate style) of seal, that was all they offered, that was in 1998 – still waiting…”

- “NHBC are worse than useless – builder failed to fix various problems – NHBC did nothing”

Owner blamed for property problems that appeared

- “3 years into my new home window problem wood cracked and they merits was my fault because I did not use the right varnish”

- “Exterior work faulty, damp encroached in house, surveyor said exterior cracks were due to us not maintaining property, less than 4 years old. Not the case but refused to allow claim.”

Poor Quality Remedial Works / Recurring Problems

- “Items replaced with similar poor quality items – which went on to fail too”

Second purchaser of property / no cover

- “I didn’t receive any warranty cover for my home. I was the second purchaser of the property. It was 6 years old at the time of my purchasing and I didn’t receive any documentation at all with regards to warranty/insurance cover.”

- “We were told the warranty was only 2 years and because it was shared equity the warranty expired after the government acquired not when we moved in so the contractor refused to fix any problems that we reported”

Not a reputable Warranty provider

- “The conveyancer said it was ‘akin’ to an NHBC. It wasn’t as there was no pressure on the builder in terms of construction standards and materials, so there have been major problems with noise insulation internally to the block”

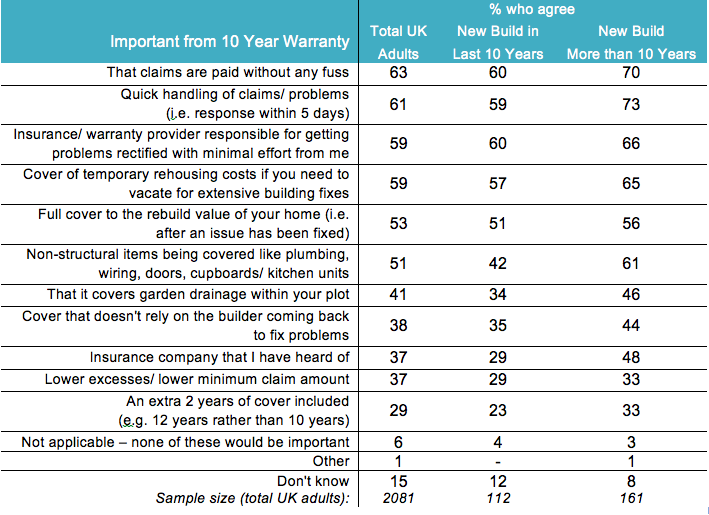

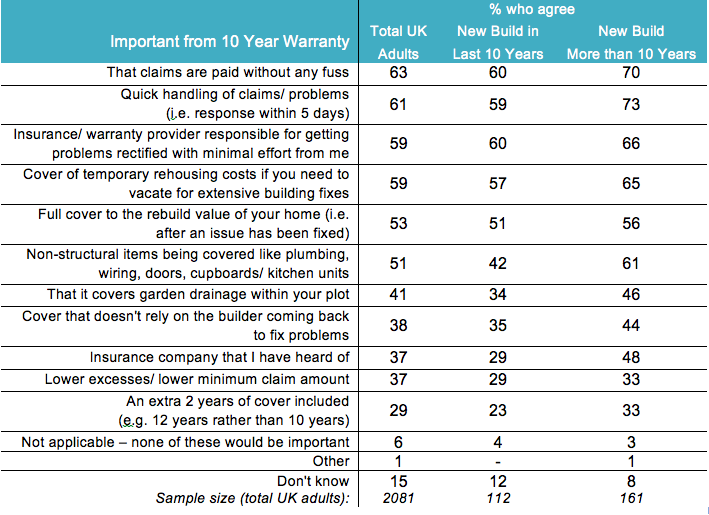

Figure 6 – Warranty Insurance – What Consumer Ideal Would Be

Figure 7 – Warranty Insurance – What Consumer Ideal Would Be (Most Important)

June 26, 2025

June 26, 2025