Recent Posts

- Half of parents wish they could help children buy a home and 1 in 4 feel guilty they can't

- New Homes Quality Code Review

- Only 40% of UK adults know what conveyancing is

- Almost 2 million aspiring homeowners don't think they'll follow in the footsteps of their parents - the generation gap worsens

- Get a 25% boost on your savings with a Cash Lifetime ISA

House Hunters get Brexit Jitters

More than 1 million UK adults say that the Brexit vote was behind their decision to put off plans to move this year.

March 27, 2017

Increasing numbers stay put due to property market concerns

- 15%, the equivalent of more than 7.5 million UK adults, put off plans to move this year

- Of these, almost one in six (15%), equating to more than 1 million UK adults, say that the Brexit vote was behind their decision

- Stamp duty costs are a factor for nearly one in ten (9%) for changing plans to buy/ move; equating to nearly 650,000 UK adults

- Rising house prices (26%), increasing cost of living (25%), difficulty securing a mortgage/re-mortgaging (25%) are other top reasons for putting off buying/moving

- Those in the North East (27%), Northern Ireland (21%) most likely to change plans

According to the annual Homeowner survey conducted by YouGov for HomeOwners Alliance and BLP Insurance, more than 1 million UK adults[1] have shelved plans to purchase a new property because of the vote to leave the European Union.

The referendum result is just one of a number of factors leading increasing numbers of British homeowners to stay put rather than move property. The research found that over 7.5 million UK adults have put off plans to move this this year.[2]

In addition to the perennial challenges around rising house prices (26%), increasing cost of living (25%) and difficulty securing a mortgage or re-mortgaging (25%), almost one in six (15%) of those who stated that they had put plans to move on hold said that the Brexit vote was behind their decision. Those in the North East (27%) and Northern Ireland (21%) were the most likely to have cancelled plans to move.

Commenting on the figures, Paula Higgins, Chief Executive of the HomeOwners Alliance said: “Our research demonstrates that both first-time buyers and those who already own a home are choosing to play it safe in these uncertain times. With the government preparing to trigger Article 50 this week, we can expect further uncertainty in the market until the UK’s future relationship with Europe is more clearly defined. People putting off plans to buy or sell chokes housing supply and generates pent up demand. The housing market needs certainty in order to be able to function most efficiently.”

“The government could help to ameliorate the situation, by looking again at stamp duty. It remains stubbornly high and acts as a drag on the market. Reducing the burden for genuine owner-occupiers could really help to keep the market moving in these uncertain times.”

Commenting on the figures, Kim Vernau, Chief Executive Officer of BLP Insurance said: “We’re at a critical juncture for the UK property industry as we await further clarity around the terms of the UK’s exit from EU. Purchasing a new home is one of the biggest decisions that an individual is ever likely to undertake, and this is only compounded by the fact that average house prices are continuing on their upward trajectory. It’s therefore not surprising that many people are putting their housing ambitions on hold amidst the prevailing uncertainty.”

Changes in Plans to Buy / Move

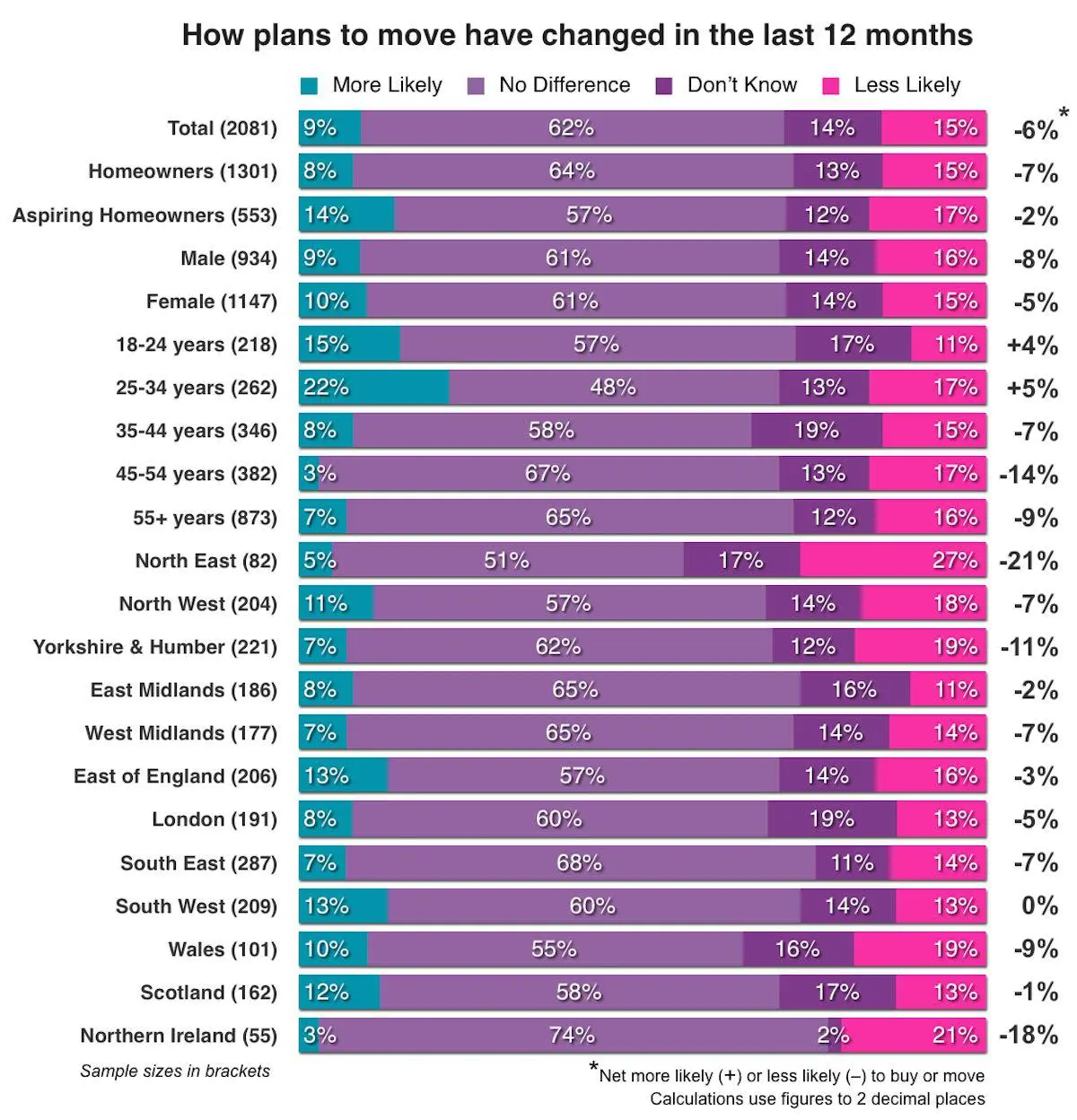

- On balance, UK adults say they have become less likely to buy or move in the past 12 months (with 9% of UK adults saying they are more likely to buy/ move and 15% saying they are less likely to do so; net -6%). See Figure 1 Change in Plans to Buy/ Move By Homeownership, Demographic Group & Region

- The proportion is similar among current homeowners. 8% of homeowners say that within the past 12 months they have become more likely to buy/ move and 15% have become less likely to do so (net -7%).

- On balance, aspiring homeowners say they have become less likely to buy or move in the past 12 months. 14% of aspiring homeowners say they have become more likely to buy/ move in the past 12 months, while 17% say they are less likely to do so (net -2%).

- Young adults age 18-34 are more likely than other age groups to say the likelihood of buying/ moving has increased in the past 12 months. Net more likely (+)/ less likely (-) to move among 18-24s is +4% and among 25-34s is +5%. Those in the age band, 45-54 years are least inclined to say the likelihood of buying/ moving has increased (net -14%).

- Regionally, those in the North East (-21%), Northern Ireland (-18%), Yorkshire & Humber (-11%) and Wales (-9%) have a greater balance of people saying they have become less likely to buy/ move in the past year.

Figure 1: Change in Plans To Buy or Move In Past Year (By Homeownership, Demographic Group, Region)

Reasons for Changing Buying / Moving Plans

- Top reasons for putting off buying/ moving plans include rising house prices (26%), rising cost of living (25%), difficulty in getting a mortgage/ remortgaging (25%), a change in needs (i.e. now no need) (24%) and the economic outlook for jobs and pay (21%).

- Brexit/ the vote to leave the European Union is a factor in changing plans among 15% of those who have become less likely to buy/ move.

- Nearly one in ten (9%) of those less likely to buy/move say more expensive stamp duty is a reason for changing their buying/ moving plans.

- Those whose plans to buy/ move have stepped up in the past year are likely to have a real need to move with 28% of these individuals saying a need for space has made them more likely to buy/ move. Downsizing is also a reason for 15% of those saying their plans to buy/ move have increased in the past year. The ability to get a mortgage (16%) and to find suitable housing (14%) are also factors among those more inclined to buy/ move.

Figure 2: Reasons For Change in Buying/ Moving Plans

| Reason | % less likely to buy/move | % more likely to buy/move |

|---|---|---|

| House prices rising | 26 | 12 |

| Rising cost of living (i.e. prices rising) | 25 | 9 |

| Difficulty/ ability getting mortgage/ remortgage | 25 | 16 |

| Needs have changed (no need now) | 24 | n/a |

| Economy (i.e. outlook for jobs and wages) | 21 | 8 |

| Ability to find suitable housing | 16 | 14 |

| Brexit/ vote to leave European Union | 15 | 7 |

| Interest rates expected to rise | 12 | 6 |

| Stress/ upheaval of moving | 12 | n/a |

| Stamp duty costs more expensive | 9 | 2 |

| Interest rates expected to fall | 3 | 3 |

| House prices falling | 2 | 4 |

| Stamp duty costs more affordable | 2 | 1 |

| Falling cost of living (i.e. prices falling) | 1 | – |

| Need more space | n/a | 28 |

| Want to downsize | n/a | 15 |

| Other | 12 | 24 |

| Don’t know | 7 | 6 |

| Sample Size | 320 | 199 |

[1] See footnote 2 below. Of those respondents who said they were less likely to buy or move, 14.69% say Brexit is a reason = 7,541,723 x 14.69% = 1,153,884

[2] 15.3% of respondents said that they were less likely to buy or move this year. 15.3% of 51,339,161 UK adults = 7,541,723

3 Of those respondents who said they were less likely to buy or move, 8.61% say stamp duty is a reason = 7,541,723 x 8.61% = 649,342

-

Sign up to our FREE weekly newsletter

for the latest news, advice and exclusive money saving offers

Let us help you…

-

Sign up to our FREE weekly newsletter

for the latest news, advice and exclusive money saving offers