Jun 2018 House Price Watch

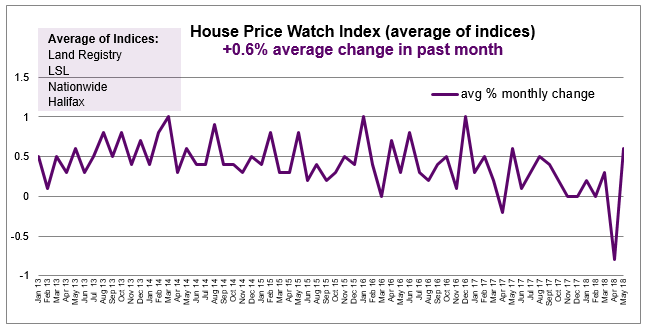

After a drop last month, house prices climb on average 0.6%

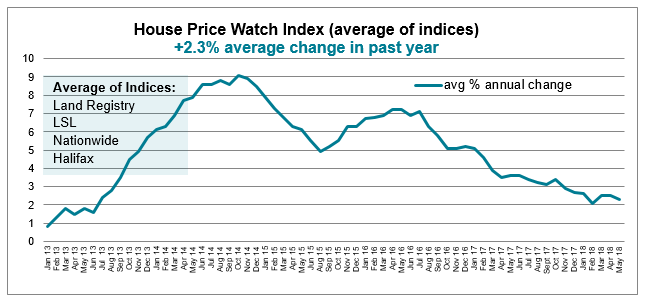

The average annual rate of house price growth slows to 2.3%

Most of the major indices report a rise in monthly house prices

The major indices indicate the following monthly changes in house prices:

- Halifax (1.5%), Land Registry (1.2%) and Rightmove (0.8%) report house prices up in the past month

- Nationwide (-0.2%) and LSL (-0.1%) report house prices down in the past month

The average of the major indices indicates house prices have risen over the past month (0.6%). The average rate of annual house price growth is down to (2.3%). (Rightmove is excluded from the average). Land Registry and LSL refer to April data. Other indices refer to May house price data.

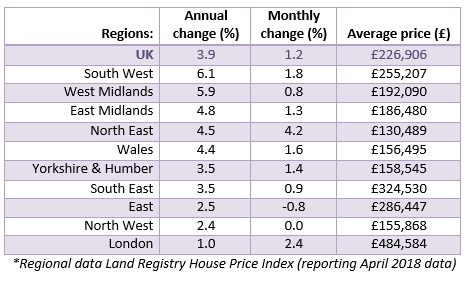

Monthly house prices rise in most regions. Notable pick-up in North East and London

For the first time this year, London has seen a positive return to house price growth. House prices are up 2.4% in the past month and up 1.0% in the past year.

Regions with the biggest monthly change in house prices include: the North East (+4.2%), London (+2.4%), South West (+1.8%) and Wales (+1.6%).

Regions with the fastest rising house prices over the past year include: the South West (6.1%) and the West Midlands (5.9%).

Home sales down 5.4% year on year

According to recent Rightmove data, the number of sales agreed by estate agents up to May 2018 is down 5.4% on the same period in 2017. London and the commuter belt are down the most. The number of year-to-date sales agreed versus 2017 down 8.5% in the South East, down 7.8% in the East of England, and down 6.9% in Greater London.

The stock of homes for sale remains tight – seller instructions are up slightly and buyer demand has eased slightly

New instructions from sellers edged upwards in May. Buyer enquiries dipped slightly overall but there is a mixed picture regionally. Average stock levels on estate agent books are relatively stable (still close to an all-time low). (RICS May, 2018 UK Residential Market Survey)

Market commentary:

HomeOwners Alliance: “While overall activity and buyer demand remains muted, the fall in house prices experienced last month has been short-lived. The ongoing shortage of homes available for sale is putting upward pressure on house prices. The market continues to reflect a varied picture regionally and, perhaps, confidence is returning to London with this month’s figures showing the first rise in house prices this year.”

RICS: “Tentatively showing some signs of stability coming through on the supply side, with the new instructions indicator moving out of negative territory for the first time in 27 months. That said, this was insufficient to shift overall market sentiment materially with activity remaining more or less flat. Moreover forward looking metrics for prices and sales suggest the market is unlikely to gain impetus, at least in the near term.”

Rightmove: “Seven out of 11 regions have hit new price records this month. However, different markets are still operating at different speeds, and the overall picture is one of a less buoyant market both in terms of price growth and number of sales agreed. After six years of continual year-on-year price growth the current market is becoming increasingly price-sensitive. Sellers need to pitch their price at a tempting level to entice buyers, as while there are signs of strong demand there appears to be hesitation among some buyers to commit.”

Nationwide: “Annual house price growth has been confined to a fairly narrow range of c2-3% over the past 12 months, suggesting little change in the balance between demand and supply in the market over that period. There are few signs of an imminent change. Surveyors continue to report subdued levels of new buyer enquiries, while the supply of properties on the market remains more of a trickle than a torrent.”

Halifax: “These latest price changes reflect a relatively subdued UK housing market. After a sharp rise in January, mortgage approvals have softened in the past three months, whilst both newly agreed sales and new buyer enquiries are showing signs of stabilisation having fallen in recent months.”

To see how we calculate our House Price Watch click here and to see previous reports click here