Ahead of the 26 November Budget, the Treasury is looking at ways to raise more money from inheritance tax as one way of plugging a hole in the country’s finances, according to reports.

Inheritance tax changes being considered include:

- Introducing a cap on lifetime gifting to limit how much money or the value of assets an individual can donate as part of their inheritance tax planning, reports the Guardian.

- Scrapping the ‘7 year rule’ for gifts or changing the rules around taper relief

Under current inheritance tax rules, no tax is due on any gifts you give if you live for 7 years after giving them – unless the gift is part of a trust. This is known as the 7 year rule.

If the person dies within 7 years of giving a gift and there’s inheritance tax to pay on it, the amount of inheritance tax due after your death depends on when you gave it.

There is a sliding scale known as ‘taper relief’ of between 8% and 32% on gifts given between 7 and 3 years before death. Money given less than 3 years before is taxed at the full inheritance tax rate of 40%. For more detailed information read our guide on Inheritance tax on property.

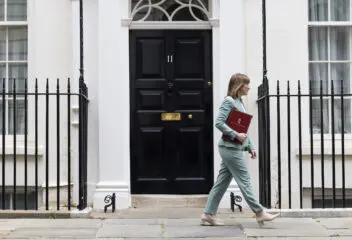

These proposals to change inheritance tax rules in the Budget 2025 would likely be part of a wider range of tax rises. The Chancellor confirmed in an interview with Sky News on 15 October that the government was considering making tax hikes at this year’s Budget, the first time she had made the admission in public.

While on 4 November, in her pre-Budget speech, the Chancellor refused to rule out breaking an election manifesto promise not to increase income tax. However, she has since backed down on increasing the main rates of income tax.

For more advice on inheritance tax, find a tax adviser specialising in estate planning through our partners at Unbiased. Book a free initial consultation today.

Find an IFA

You don’t have to make life’s big financial decisions alone. Get the right IFA for you today with our partners at Unbiased.

Find an IFA

What would these inheritance tax changes mean?

Introducing an inheritance tax lifetime cap means more people would likely pay inheritance tax and greater amounts.

Similarly, by scrapping the 7 year inheritance tax rule or making changes to taper relief, the expectation would be that more people would pay greater amounts of inheritance tax.

David Sturrock, of the Institute for Fiscal Studies, said that chancellor Rachel Reeves was unlikely to be able to raise significant sums from inheritance tax without hitting small gifts made by middle earners, reports The Times.

Inheritance tax news

These proposals follow inheritance tax changes outlined in the 2024 Autumn budget where chancellor Rachel Reeves said:

- Inheritance tax thresholds will stay the same until 2030.

- From April 2027, inherited pension funds will no longer be exempt from inheritance tax.

Under current rules, when you die any money that’s left in a private pension fund can be passed on to your loved ones free of inheritance tax.

The government estimates that 10,500 estates will have an Inheritance Tax liability as a result of these inheritance tax and pension changes and around 38,500 estates will pay more inheritance tax than would previously have been the case.

However, many homeowners have already taken action to protect themselves from these inheritance tax changes, according to reports.

Equity release advisers report having seen a rise in enquiries from over-55s following the inheritance tax changes announced in last year’s Budget.

- In fact, there was a 10% year on year increase in the total unlocked from homes in the second quarter of 2025, according to the Equity Release Council. It said this trend was mainly driven by new borrowers taking £126,422 on average from their properties.

The most common type of equity release are lifetime mortgages. These allow homeowners over 55 to borrow against their homes in return for a tax-free lump sum. This loan is repaid when the borrower dies or moves into long-term care. Find out more about the different types of equity release and how they work in our guide Is equity release right for me?

Andy Shaw, of broker SPF Private Clients, told The Telegraph he had seen more inquiries from homeowners looking to gift money following the Government’s inheritance tax changes:

“We expect this to continue as we move nearer to April 2027, when pensions are due to fall into the inheritance tax calculation,” he said.

“Most commonly, the funds released are gifted by the borrowers to their children or grandchildren, and will usually become a potentially exempt transfer, and thus fall outside of their estate after seven years.”

The UK government has also announced plans, beginning in April 2026, to tax inherited agricultural assets worth more than £1m at 20%, this is half the usual rate.

For more advice on inheritance tax, find a tax adviser specialising in estate planning through our partners at Unbiased. Book a free initial consultation through our partners at Unbiased.

Find an IFA

You don’t have to make life’s big financial decisions alone. Get the right IFA for you today with our partners at Unbiased.

Find an IFA

Proposed inheritance tax changes: Our view

Paula Higgins, CEO of HomeOwners Alliance, said:

“We believe inheritance tax should not penalise ordinary families whose only significant asset is their home. Rising property prices, particularly in cities, now mean that many ordinary families are being unfairly dragged into inheritance tax — not because they are wealthy, but simply because they own a home..

“Families pay income tax to earn the money, and stamp duty when buying their home. Taxing that same home again on death through inheritance tax amounts to double taxation.

“We support reforms that protect the family home, ensure thresholds rise in line with house prices, and simplify the system so families can plan for the future with confidence.”

Using life insurance to pay inheritance tax

If you’re concerned that these inheritance tax changes could leave a big bill for your loved ones to pay when you die, you do have options.

- For example, you may consider taking out a life insurance policy to pay some or all of the inheritance tax due.

This can ease the financial burden your loved ones will face and can also protect your home and other assets from needing to be sold to pay an inheritance tax bill.

It can be particularly useful if the tax needs to be paid before your estate can be distributed.

But most life insurance policies will count as part of the estate unless your policy is written ‘in trust’. This doesn’t cost anything extra and you can do it when taking out your policy.

Writing life insurance in trust essentially means that the pay out is paid to your beneficiaries and not to your legal estate. This means it won’t be taken into account when inheritance tax is calculated. For more information, read our guide Do I need life insurance?

Compare life insurance quotes, buy online and put your policy into trust using the service provided by LifeSearch.

Get Life Insurance Quotes

Get fee-free advice and quotes from leading UK insurers

Get advice & quotes

Current inheritance tax thresholds in 2025-26

In the 2025-2026 tax year, everyone has a tax-free inheritance tax allowance of £325,000 – this is known as the nil-rate band.

If your estate is below £325,000, then it sits in your “nil-rate band” and no tax is payable. But if the value of your estate is above £325,000, everything above that threshold is subject to inheritance tax rate of 40%.

However there are some exceptions to this rule:

- Inheritance tax spouse exemption There is no inheritance tax payable when inheriting from a dead spouse or civil partner and you will also inherit your spouse’s unused nil-rate band. There is also normally no tax to be paid if you leave everything above the threshold to an exempt beneficiary, such as a charity or a community amateur sports club.

- Inheritance tax on property when passing on a home: You may be able to increase the threshold at which inheritance tax is payable if you pass on a property as long as you leave it to direct descendants thanks to the ‘Residence nil-rate band’. This is an additional property allowance of £175,000 in the tax year 2025-2026.

This means an individual dying could pass on assets worth up to £500,000 tax free. Married couples and those in civil partnerships can transfer any unused nil-rate band when the first person dies to the survivor. This means a couple could pass on up to £1,000,000 without being liable for inheritance tax. Find more detailed information in our guide on Inheriting a house.

Get Personalised Tax Advice Today

Avoid any rash and potentially irreversible decisions by speaking to a qualified financial adviser.

Whether giving or receiving an inheritance, a financial plan tailored to you by an expert can help minimise IHT and curb Budget anxiety. Find a tax adviser specialising in estate planning through our partners at Unbiased. Book a free initial consultation today.

Find an IFA

You don’t have to make life’s big financial decisions alone. Get the right IFA for you today with our partners at Unbiased.

Find an IFA

How this site works

HomeOwners Alliance Ltd is registered in England, company number 07861605. Information provided on HomeOwners

Alliance is not intended as a recommendation or financial advice.

Mortgage service provided by London & Country Mortgages (L&C), Unit 26 (2.06), Newark Works, 2 Foundry Lane, Bath

BA2 3GZ, authorised and regulated by the Financial Conduct Authority (FRN: 143002). The FCA does not regulate

most Buy to Let mortgages. Your home or property may be repossessed if you do not keep up repayments on your

mortgage.

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of LifeSearch Limited, an Appointed

Representative of LifeSearch Partners Ltd, authorised and regulated by the Financial Conduct Authority. (FRN:

656479).

Independent Financial Adviser service is provided by Unbiased, who match you to a fully regulated, independent

financial adviser, with no charge to you for the referral.

Bridging Loan and specialist lending service provided by Chartwell Funding Limited, registered office 5 Badminton Court, Station Road, Yate, Bristol, BS37 5HZ, authorised and regulated by the Financial Conduct Authority (FRN: 458223). Your property may be repossessed if you do not keep up repayments on a mortgage or any debt secured on it.

February 3, 2026

February 3, 2026